Executive Summary: The Birth of Permissionless Sports Betting

A $200 million proof-of-concept that DeFi can conquer mainstream consumer verticals

In the sprawling landscape of decentralized finance, where protocols routinely handle billions in total value locked but struggle to attract mainstream users, one application stands as a remarkable exception: Overtime Markets.

Operating as a fully onchain, permissionless sports betting protocol, Overtime has achieved what most DeFi applications only dream of—genuine product-market fit with real consumers. With over $200 million in total betting volume across more than 50,000 active users and 10,000+ unique betting markets, it represents the first successful translation of complex DeFi primitives into a consumer experience that rivals traditional Web2 applications.1

THE CORE THESIS

This investigation reveals three fundamental innovations that position Overtime Markets as a watershed moment for decentralized consumer applications:

1. TECHNICAL BREAKTHROUGH: Overtime successfully adapted core DeFi primitives—specifically Automated Market Makers (AMMs), permissionless liquidity pools, and DAO governance—to the nuanced requirements of sports betting, creating instant liquidity and trustless settlement.1

2. USER EXPERIENCE REVOLUTION: Through comprehensive Account Abstraction implementation, Overtime has eliminated the technical barriers that traditionally prevent mainstream adoption of Web3 applications, enabling social login and gasless transactions.2

3. ECONOMIC FLYWHEEL: The $OVER token creates a self-reinforcing value accrual mechanism where platform growth directly translates to token appreciation through transaction fees and a deflationary buyback-and-burn system.3

THE REGULATORY PARADOX

Yet Overtime’s defining strength—its decentralized, permissionless, and unlicensed nature—simultaneously constitutes its most significant existential risk. Operating without traditional gaming licenses places the protocol in an uncertain regulatory gray area that could fundamentally challenge its business model.

THE VERDICT

Overtime Markets represents a best-in-class example of how DeFi can successfully penetrate mainstream consumer markets. Its future trajectory depends not on technological innovation—which it has already mastered—but on its ability to navigate an increasingly complex global regulatory landscape while maintaining the permissionless principles that define its value proposition.

Chapter 1: The Technological Foundation - Building Sports Betting on Blockchain

How Overtime Markets engineered a trustless alternative to traditional sportsbooks

Understanding Overtime Markets requires examining its sophisticated technical architecture—a carefully orchestrated combination of battle-tested DeFi protocols, cutting-edge scaling solutions, and innovative user experience enhancements that collectively create a fully decentralized betting ecosystem.

The Thales Protocol Legacy: From Binary Options to Sports AMM

Overtime Markets didn’t emerge in isolation. It evolved from the Thales Protocol, an oracle-based liquidity and settlement layer originally designed for onchain positional markets and binary options.4 This evolutionary lineage provided Overtime with a critical advantage: instead of building smart contracts from scratch, it leveraged a pre-existing, audited framework already proven in production.

THE STRATEGIC EVOLUTION

The transformation from Thales to Overtime represents one of DeFi’s most successful product pivots:

• Original Focus: Binary options and prediction markets with limited traction

• Pivot Decision: DAO recognized sports betting showed superior product-market fit

• Strategic Merger: Thales community unanimously approved full rebranding to Overtime

• Result: Concentrated resources on the most successful application

This demonstrates the effectiveness of decentralized governance in making strategic decisions based on clear market signals—a rare success story in DAO management.1

The technical foundation inherited from Thales includes:

Core Smart Contract Infrastructure: Battle-tested positional market contracts that power Overtime’s Sports AMM and Parlay AMM, providing the instant liquidity necessary for a seamless betting experience.2

Oracle Integration: Established relationships with data providers like Chainlink for secure, decentralized sports data feeds.1

Governance Framework: Mature DAO structures including the TIP (Thales Improvement Proposal) system for protocol upgrades.5

Layer 2 Deployment Strategy: Scaling Beyond Ethereum’s Limitations

Overtime’s architectural foundation rests on a crucial strategic decision: exclusive deployment on Ethereum Layer 2 networks, specifically Optimism, Arbitrum, and Base.1

THE SCALABILITY IMPERATIVE

This multi-chain L2 strategy directly addresses Ethereum mainnet’s fundamental limitations:

• Cost Efficiency: High gas fees would make microbetting economically unviable

• Transaction Throughput: Sports betting requires high-frequency, low-latency transactions

• User Experience: Slow confirmation times would destroy the real-time betting experience

DEPLOYMENT ANALYSIS

Optimism (Home Chain): Primary deployment with deepest liquidity pools Arbitrum: Significant presence with tens of millions in volume processed6 Base: Strategic expansion to access Coinbase’s user ecosystem6

This multi-chain approach provides operational resilience and access to distinct user communities native to each network, while mitigating dependence on any single L2’s performance.

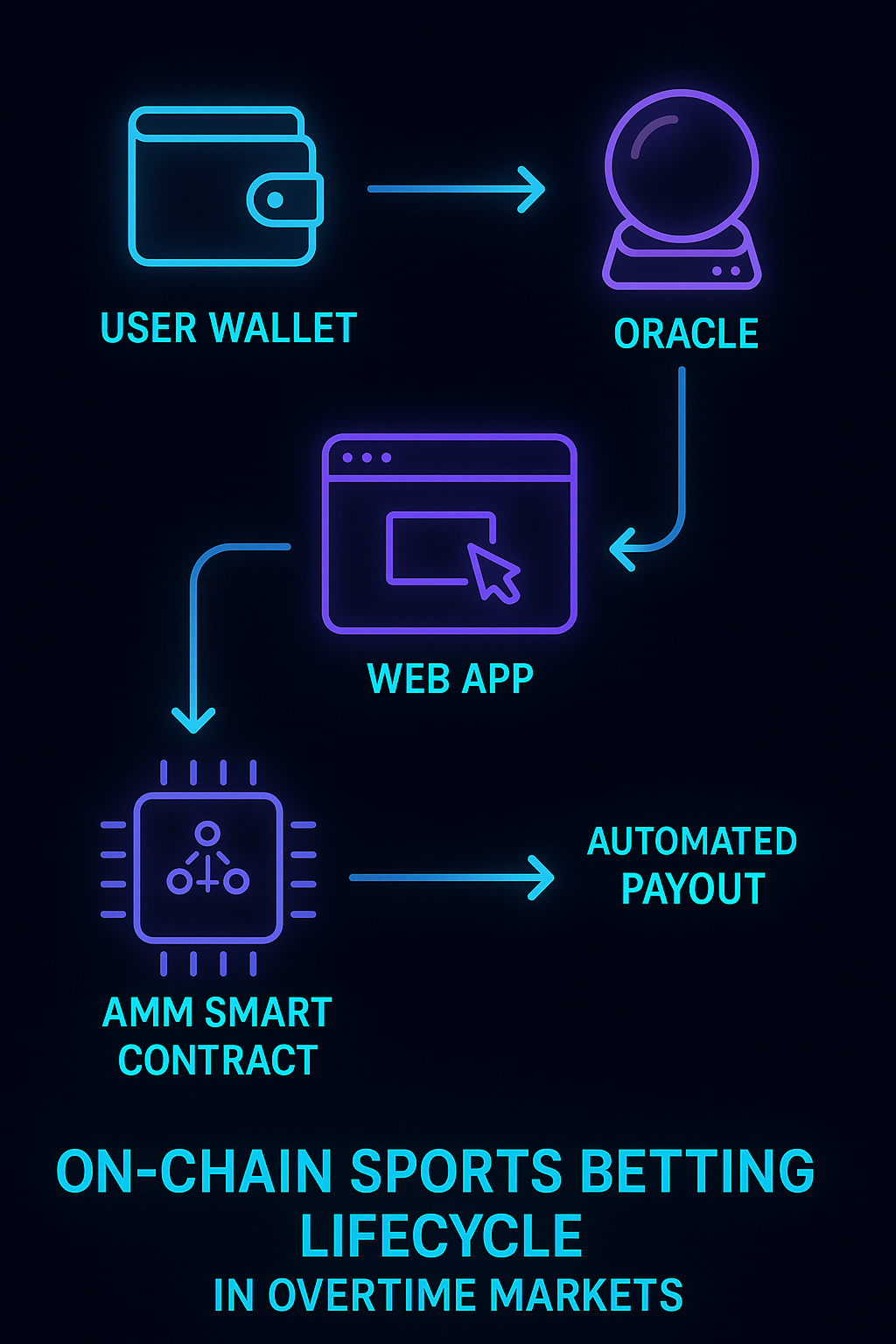

Smart Contract Architecture: Trustless Execution from Bet to Payout

Overtime’s operational integrity depends on immutable smart contracts governing every aspect of the betting lifecycle:

BETTING PROCESS FLOW

- Market Creation: Sports data feeds trigger automatic market generation

- Odds Calculation: AMM algorithms determine initial pricing based on Pinnacle feeds2

- Bet Placement: Users interact directly with smart contracts via gasless transactions

- Settlement: Oracle data automatically triggers payouts without intermediation

- Payout Distribution: Funds flow directly to user wallets via programmatic execution

ORACLE INTEGRATION

The protocol’s trustless nature requires reliable real-world data:

• Primary Provider: Chainlink for sports results and initial odds feeds1 • Secondary Integration: OpticOdds for advanced features like live betting7 • Decentralized Model: Multiple data sources reduce single points of failure

This architecture eliminates counterparty risk inherent in traditional sportsbooks, where central operators can arbitrarily change terms, delay payouts, or manipulate settlement processes.2

Account Abstraction: Engineering Web2 UX on Web3 Rails

Perhaps the most strategically significant development in Overtime’s evolution is the implementation of comprehensive Account Abstraction (AA) through partnerships with Particle Network and Biconomy.1

THE USER EXPERIENCE TRANSFORMATION

Traditional Web3 onboarding requires:

• Manual wallet creation and seed phrase management

• Gas token acquisition for transaction fees

• Manual transaction signing for every interaction

• Understanding of blockchain concepts

Overtime’s AA Solution:

• Social Login: Google, Twitter, and other Web2 credential integration

• Gasless Transactions: Protocol covers network fees automatically

• Smart Contract Wallets: User-friendly “Overtime Accounts” with advanced features

• Seamless Onboarding: Web2-familiar registration process

STRATEGIC IMPLICATIONS

This represents more than user experience enhancement—it’s a competitive moat against other onchain sportsbooks that still require conventional Web3 wallet interactions. By making onboarding nearly indistinguishable from traditional web applications, Overtime positions itself to compete for mainstream sports bettors, not just crypto-native users.

The technical sophistication of this implementation suggests a deep understanding that technological innovation alone is insufficient for mass adoption—the product must be accessible, efficient, and enjoyable to use.

Chapter 2: Market Position and Competitive Analysis

How Overtime Markets carved out a unique position in the $455 billion global sports betting market

Overtime Markets operates in a fiercely competitive environment, facing challenges from both established centralized crypto betting platforms and emerging decentralized protocols. Its strategic positioning reveals a deliberate trade-off: prioritizing the principles of decentralization over the broader feature sets and regulatory compliance of incumbent operators.

The Centralized Competition: David vs. Goliath

INCUMBENT ANALYSIS: Stake.com and Cloudbet

The primary competitors in the crypto betting space are large, centralized platforms that have operated for years and command significant market share:

• Market Position: Established brands with vast user bases • Feature Breadth: Comprehensive offerings including casinos, live dealers, and multiple betting verticals • Regulatory Approach: Traditional gaming licenses (often offshore jurisdictions like Curaçao) • User Experience: Web2-familiar interfaces with established brand recognition

CENTRALIZED MODEL VULNERABILITIES:

Despite their market dominance, centralized platforms exhibit fundamental weaknesses that Overtime exploits:

• Custodial Risk: Users deposit funds into platform-controlled wallets • KYC Requirements: Mandatory identity verification processes • Arbitrary Restrictions: Platforms can limit or ban successful bettors at will • Counterparty Risk: Central operators control settlement and payout processes

OVERTIME’S POSITIONING STRATEGY

Overtime directly targets these vulnerabilities by positioning itself as the antithesis to centralized operators:

• Self-Custody: Users maintain full control over their assets • Permissionless Access: No KYC or geographic restrictions • Censorship Resistance: Immutable smart contracts prevent arbitrary bans • Trustless Settlement: Automated payouts via blockchain execution

This creates a classic disruptor dynamic where Overtime bets that a growing market segment will prioritize user sovereignty and censorship resistance over incumbent brand recognition and feature breadth.

Odds Competitiveness: Technical Analysis

PRICING COMPARISON WITH TRADITIONAL SPORTSBOOKS

For any sportsbook to succeed, odds must be competitive with market leaders. Overtime addresses this critical requirement through sophisticated pricing mechanisms:

Odds Generation Process:

- Initial Feed: Sources opening lines from Pinnacle, known for sharp pricing2

- AMM Adjustment: Applies “safebox fee” and adjusts for betting flow imbalance

- Dynamic Pricing: Real-time updates based on supply and demand

- Market Validation: User reports confirm “really competitive if not better” odds for wagers under $1,0002

COMPETITIVE ANALYSIS: UFC 305 CASE STUDY

Direct market comparison for Dricus Du Plessis vs. Israel Adesanya:

| Platform | Du Plessis | Adesanya | Margin |

|---|---|---|---|

| Overtime Markets | +105 | -125 | ~4.8% |

| BetMGM | +100 | -120 | ~4.5% |

| FanDuel | +102 | -122 | ~4.7% |

| DraftKings | +100 | -120 | ~4.5% |

ANALYSIS: Overtime achieves near-parity with major centralized books, effectively neutralizing a primary potential disadvantage of the DeFi platform.8

Feature Parity Assessment

CURRENT FEATURE SET

Overtime has systematically built feature parity with traditional sportsbooks:

• Market Coverage: 100+ sports and leagues globally1 • Bet Types: Moneylines, parlays, same-game parlays, futures, live betting1 • Advanced Features: System bets, parlay combinations up to 8 legs2 • Real-Time Betting: Live betting infrastructure in V2 architecture1

REMAINING GAPS

• Liquidity Limitations: Maximum bet sizes (~$18,000 for major NBA games) below traditional books9 • Prop Market Depth: Limited niche proposition bets compared to mature Web2 platforms • Ancillary Features: No casino games or non-sports betting verticals

The Decentralized Competition: Overtime vs. Azuro

Within the emerging onchain sportsbook category, Overtime faces competition from protocols like Azuro. While detailed comparative data is limited, the competitive dynamic will likely accelerate innovation in:

• Liquidity Models: Different approaches to market making and capital efficiency

• User Experience: Race to eliminate Web3 complexity

• Oracle Integration: Reliability and speed of sports data feeds

• Feature Development: Speed of implementing new betting products

Overtime’s early and aggressive adoption of Account Abstraction provides a significant competitive advantage in user acquisition and retention.

Regulatory Arbitrage: The Double-Edged Sword

THE PERMISSIONLESS ADVANTAGE

Overtime’s unlicensed, decentralized model enables unique value propositions:

• Global Access: No geographic restrictions or country blocking • Sharp Bettor Haven: Successful players cannot be banned or limited • Instant Withdrawals: No approval processes or delayed payouts • Privacy Protection: No mandatory KYC or personal data collection

THE REGULATORY RISK

This same permissionless nature represents existential risk:

• Legal Uncertainty: Operating without gaming licenses creates regulatory exposure • Enforcement Action: Potential government intervention could disrupt operations • Banking Challenges: Traditional payment integration may face restrictions • Compliance Pressure: Future regulatory requirements could compromise core features

The regulatory landscape will likely be the ultimate determinant of Overtime’s competitive position relative to both centralized and decentralized alternatives.

Chapter 3: Economic Architecture - The $OVER Token and DeFi Mechanics

Dissecting the tokenomics and liquidity dynamics that power Overtime’s economic engine

The long-term viability of Overtime Markets depends on a sophisticated economic model that aligns stakeholder interests while creating sustainable revenue streams. At the center of this system lies the $OVER token and a decentralized liquidity framework that transforms users into active participants in the platform’s financial outcomes.

The $OVER Token: Multi-Utility Asset Design

TOKEN MIGRATION AND SUPPLY OPTIMIZATION

The $OVER token emerged from a strategic evolution of the parent Thales ecosystem. The migration from $THALES to $OVER involved:

• 1:1 Token Swap: All existing $THALES holders automatically received $OVER • Strategic Burn: 30.58 million tokens permanently removed from circulation • Optimized Supply: Total supply reduced from 100 million to 69.42 million tokens • Deflationary Foundation: Created more sustainable tokenomic structure from launch3

MULTI-FACETED UTILITY FRAMEWORK

The $OVER token integrates multiple utility mechanisms:

1. Governance Rights • Proportional voting power in Overtime DAO decisions • Participation in protocol parameter changes • Treasury management oversight • Strategic development direction3

2. Betting Collateral Incentive

• 2% odds improvement when using $OVER as betting collateral1

• Direct utility-driven demand creation

• Economic incentive for token acquisition and usage

• Bridges passive holding with active platform participation

3. Value Accrual Mechanism

• Platform fees fund automatic token buybacks

• Purchased tokens permanently burned from circulation

• Creates deflationary pressure correlated with platform activity3

This multi-utility design ensures $OVER functions as more than speculative asset—it becomes integral infrastructure for platform operations.

Buyback-and-Burn: Automated Value Distribution

MECHANISM ANALYSIS

Overtime implements a transparent, automated value accrual system:

Revenue Flow:

- Fee Generation: All betting activity generates platform fees

- Smart Contract Routing: Fees automatically directed to buyback contract

- DEX Purchases: Contract systematically buys $OVER from Uniswap/Velodrome3

- Permanent Burn: Acquired tokens removed from circulation forever

ECONOMIC IMPACT

This creates direct correlation between platform success and token scarcity:

• Volume Increase → Higher Fee Revenue → Accelerated Buybacks → Supply Reduction

• Transparent Process: All transactions visible on blockchain

• Automatic Execution: No discretionary management or potential manipulation

• Stakeholder Alignment: Token holders benefit directly from platform growth

The mechanism transforms platform users into indirect shareholders, as their betting activity funds token appreciation for the broader ecosystem.

Liquidity Provision: Becoming the House

DEMOCRATIZED MARKET MAKING

One of Overtime’s most innovative features allows any user to “become the house” by providing liquidity to AMM pools:

Liquidity Provider Process:

- Capital Deposit: Users contribute USDC, ETH, or BTC to platform pools4

- Risk Assumption: LPs become counterparty to all platform bets

- Revenue Sharing: Earn proportional share of net platform profits

- Market Exposure: Subject to variance in bettor performance

RISK-REWARD ANALYSIS

This presents a unique investment profile with historical performance data:

Arbitrum Market (Mature): • LP Returns: >100% gains since inception9 • Volume Base: Large, diverse betting activity • Risk Mitigation: Law of large numbers reduces variance

Base Market (Emerging):

• LP Performance: Net losses in early operation9

• Risk Factor: Smaller market size increases variance exposure

• Variance Risk: Large individual wins can impact returns significantly

V2 SIMPLIFICATION

The platform upgrade streamlined LP experience: • Pool Merger: Combined single and parlay betting pools10 • Reduced Complexity: Simplified decision-making for prospective LPs • Enhanced Capital Efficiency: Better utilization of deposited assets

Collateral Evolution: From Complexity to Simplicity

HISTORICAL PROGRESSION

Early versions supported multiple stablecoins (sUSD, DAI, USDC, USDT) creating operational complexity.2 V2 architecture implemented strategic simplification:

Current Collateral Framework: • Primary: USDC as standardized stable asset across all chains10 • Native Integration: ETH support eliminates swap friction10 • Risk Management: Reduced de-pegging exposure from stablecoin fragmentation

STRATEGIC ADVANTAGES

• User Experience: ETH integration eliminates conversion steps for Ethereum users • Capital Efficiency: Direct ETH usage improves DeFi protocol composability • Risk Mitigation: USDC standardization reduces stablecoin volatility exposure

The Economic Flywheel: Self-Reinforcing Growth

THEORETICAL FRAMEWORK

The integration of these economic components creates potential for virtuous growth cycles:

The Flywheel Effect:

- Increased Platform Usage generates higher fee revenue

- Higher Fee Revenue accelerates buyback-and-burn mechanism

- Token Supply Reduction creates appreciation pressure

- Higher Token Value makes 2% odds boost more attractive

- Increased Token Demand drives further platform engagement

- Return to Step 1 with expanded user base and activity

EMPIRICAL VALIDATION

With $200+ million in platform volume and 50,000+ active users, early evidence suggests this flywheel is operational, though long-term sustainability depends on continued user growth and regulatory acceptance.

RISK FACTORS

• Regulatory Disruption: Legal challenges could break the flywheel • Competitive Pressure: Better alternatives could reduce platform usage • Market Volatility: Crypto market dynamics could override token mechanics • Technical Risks: Smart contract vulnerabilities could undermine trust

The economic architecture represents sophisticated DeFi design, but its success ultimately depends on execution and external market conditions.

Chapter 4: User Acquisition and Community Building

How Overtime Markets leverages Web3-native strategies to build a loyal user base

Overtime Markets has developed a sophisticated user acquisition strategy that goes far beyond traditional marketing approaches. By leveraging gamification, token incentives, and community-oriented campaigns, the platform creates engagement mechanisms native to the Web3 ecosystem while building genuine product stickiness.

The Overdrop League: Gamifying Loyalty

PROGRAM ARCHITECTURE

The “Overdrop League” transforms sports betting from transactional activity into persistent, game-like progression:

Experience Points (XP) System:

• Earning Mechanism: XP awarded for every bet based on formula considering both wager size and normalized odds11

• Progressive Rewards: Each level unlocks permanent boosts to future XP accrual rates11

• Season Structure: Long-term engagement cycles with major prize pools

• Skill Recognition: Rewards both high-volume and high-skill betting strategies

Prize Distribution: • Total Pool: 100,000 OP + 200,000 ARB tokens per season11 • Pro-Rata Distribution: Rewards based on final XP totals11 • Community Building: Creates shared experience and competition among users

BEHAVIORAL PSYCHOLOGY

This system leverages proven game design principles:

• Progress Visualization: Clear advancement through leveling system

• Compound Benefits: Permanent boosts create increasing returns for engagement

• Social Competition: Leaderboards foster competitive community dynamics

• Delayed Gratification: Season-long campaigns build anticipation and retention

The gamification transforms individual bets into components of a larger, persistent achievement system.

Token Incentive Strategies: Beyond Traditional Bonuses

CRYPTO-NATIVE INCENTIVE MODEL

Overtime deploys Web3-specific user acquisition tools:

Direct Token Rewards: • Free Bet Credits: Cryptocurrency airdrops distributed to active users1 • Fee Rebates: L2 foundation grants (Optimism, Arbitrum) fund user rewards12 • Volume Bonuses: Activity-based token distribution creates loyalty incentives

Event-Specific Campaigns: • March Madness Program: Soul-bound NFT brackets with 40,000 THALES + 13,000 OP prize pools2 • World Cup Campaign: Predictive NFTs providing volume bonuses for correct picks2 • Major Event Integration: Targeted promotions around global sporting events

STRATEGIC ADVANTAGES

This approach creates unique benefits compared to traditional sportsbook marketing:

Ecosystem Token Distribution: • L2 Alignment: Using OP/ARB tokens creates three-way value creation • Non-Dilutive Marketing: Grant funding provides marketing budget without token inflation • Network Effect: Users become stakeholders in broader blockchain ecosystems

Long-Term Engagement: • Ownership Mindset: Token rewards create psychological ownership • Community Investment: Users become advocates for platform success • Sustainable Model: Grant relationships provide ongoing marketing resources

Comparative Analysis: Web3 vs Traditional Sportsbook Marketing

TRADITIONAL SPORTSBOOK APPROACH

Conventional platforms rely on front-loaded acquisition:

• Deposit Matches: Cash bonuses for initial funding

• Risk-Free Bets: “No sweat” first wager promotions

• Bonus Bet Credits: House money with wagering requirements

• Transactional Focus: One-time incentives to drive sign-ups13

OVERTIME’S DIFFERENTIATED STRATEGY

Community-Centric Model: • Ongoing Rewards: Continuous incentive structure throughout user lifecycle • Shared Success: Token rewards align user and platform interests • Transparent Distribution: Blockchain-based reward systems eliminate opacity • Ecosystem Building: Users become participants, not just customers

EFFECTIVENESS ANALYSIS

Traditional bonuses create initial engagement but limited loyalty: • High Churn Rates: Users often abandon platforms after bonus consumption • Complex Terms: Wagering requirements create friction and dissatisfaction • Regulatory Overhead: Bonus structures face increasing scrutiny

Overtime’s model builds sustained engagement:

• Compound Loyalty: Each interaction strengthens platform relationship

• Community Effects: Social dynamics encourage retention and referrals

• Value Creation: Token rewards appreciate with platform success

Growth Metrics and Performance Indicators

QUANTITATIVE RESULTS

The effectiveness of Overtime’s user acquisition strategy is reflected in key metrics:

• Total Users: 50,000+ active participants1

• Volume Processed: $200+ million across all markets1

• Market Coverage: 10,000+ unique betting opportunities1

• Multi-Chain Presence: Successful deployment across 3 L2 networks

QUALITATIVE INDICATORS

Community sentiment suggests genuine product-market fit: • User Testimonials: Reddit users describe Overtime as destination for “sharp bettors”14 • Organic Growth: Word-of-mouth referrals from satisfied users • Retention Metrics: Repeat usage patterns indicating sticky user base

COMPETITIVE POSITIONING

The growth strategy positions Overtime advantageously:

• Differentiated Approach: Web3-native user acquisition creates moat vs. traditional marketing

• Scalable Model: Token incentive systems can expand with platform growth

• Regulatory Resilience: Decentralized reward distribution faces fewer restrictions

The user acquisition framework demonstrates sophisticated understanding of Web3 user psychology while building genuine community around the platform’s success.

Chapter 5: Governance, Security, and Risk Assessment

Examining the decentralized governance model, security infrastructure, and regulatory challenges facing Overtime Markets

The success of any DeFi protocol depends not only on its technical innovation and user experience but also on its governance mechanisms, security practices, and ability to navigate regulatory uncertainty. Overtime Markets’ approach to these critical areas reveals both strengths and potential vulnerabilities that could determine its long-term viability.

Decentralized Governance: The DAO in Action

GOVERNANCE STRUCTURE ANALYSIS

Overtime operates through the Overtime DAO (formerly Thales DAO), which manages protocol decisions through a sophisticated governance framework:

Thales Improvement Proposal (TIP) System: • Public Repository: All proposals tracked transparently on GitHub15 • Community Participation: $OVER holders vote proportionally to token stakes2 • Active Development: Extensive history of implemented proposals • Democratic Process: Community-driven protocol evolution

The Thales Council: • Composition: Seven community members elected by token stakers16 • Term Structure: Four-month terms ensure regular accountability • Executive Function: Reviews and votes on TIPs as DAO representative body • Operational Efficiency: Provides structure while maintaining decentralization

GOVERNANCE TRACK RECORD

The DAO has demonstrated effective decision-making capability through significant protocol changes:

Strategic Decisions: • TIP-37: Terminated retroactive SNX staker rewards to protect token liquidity17 • TIP-109/110: Added double chance, spread, and total points markets15 • TIP-123: Funded alternative community-built front-end for decentralization18 • TIP-207: Integrated OpticOdds data provider for live betting capabilities7

GOVERNANCE EFFECTIVENESS

The track record suggests a functional governance system capable of: • Strategic Adaptation: Major pivots like the Thales-to-Overtime merger • Technical Upgrades: Systematic feature additions and protocol improvements • Risk Management: Proactive measures to protect token economics • Decentralization: Supporting multiple front-ends and community initiatives

This governance framework potentially provides legal protection by distributing decision-making across a decentralized community rather than centralized management.

Security Infrastructure: Audit History and Risk Assessment

INHERITED SECURITY FOUNDATION

Overtime’s security posture benefits from its Thales Protocol foundation, which has undergone extensive third-party auditing:

Comprehensive Audit History: • iosiro (August-September 2021): Thales Airdrop and Staking contracts19 • iosiro (June 2021): Binary Option Market smart contracts20 • Multiple Additional Audits: Parlay AMM, core AMM, and specialized components21 • Remediation Record: Documented resolution of identified vulnerabilities

AUDIT FINDINGS ANALYSIS

**iosiro Airdrop/Staking Audit Results:**19 • 3 High-Risk Issues: Including ERC-20 standard violations and underflow vulnerabilities • 2 Medium-Risk Issues: Additional security concerns identified • Complete Remediation: All findings addressed and verified

**iosiro Binary Options Audit Results:**20

• 1 High-Risk Issue: Fee rounding could prevent option exercises

• 1 Medium-Risk Issue: Front-running vulnerability identified

• Full Resolution: All vulnerabilities patched before deployment

SECURITY ASSESSMENT LIMITATIONS

While the audit history is extensive, certain gaps require consideration:

• Component-Specific Audits: Reviews covered modular parts, not fully integrated V2 system • Account Abstraction Layer: New AA implementation may lack comprehensive audit coverage • Integration Risks: Complex interactions between components could introduce new vulnerabilities • Ongoing Evolution: Continuous development requires ongoing security assessment

Regulatory Landscape: The Unlicensed Frontier

THE FUNDAMENTAL REGULATORY CHALLENGE

Overtime’s core value proposition—permissionless, unlicensed global access—simultaneously represents its greatest existential risk:

Legal Status Analysis:

• No Gaming License: Operates without traditional regulatory approval in any jurisdiction

• Global Access: Available worldwide without geographic restrictions

• Legal Entity: Based in Willemstad, Curaçao (minimal regulatory oversight)22

• Regulatory Gray Area: DeFi protocols face uncertain legal classification

COMMUNITY LEGAL DISCOURSE

The regulatory uncertainty has generated significant discussion within the crypto community:

Risk Perspectives: • Criminal Activity Concerns: Some users note potential legal issues for participants23 • Decentralization Defense: Others argue direct smart contract interaction may fall outside traditional gambling regulation23 • Tornado Cash Parallels: Legal arguments about tool usage vs. service provision23

Jurisdictional Complexity: • United States: SEC and other agencies still defining DeFi regulatory framework24 • European Union: Developing comprehensive crypto regulation including gambling applications • Asian Markets: Varying approaches to cryptocurrency and DeFi protocol oversight • Emerging Markets: Limited regulatory frameworks but potential for rapid change

Risk Assessment: Threats to Platform Viability

REGULATORY ENFORCEMENT RISK

Highest probability, highest impact threat:

• Government Action: Coordinated regulatory crackdown could force protocol shutdown

• Banking Restrictions: Traditional payment integration could face regulatory pressure

• User Criminalization: Legal risks for users could reduce adoption

• Compliance Requirements: Mandatory KYC/AML could compromise core value proposition

TECHNICAL VULNERABILITY RISK

Lower probability, high impact threat: • Smart Contract Exploits: Undiscovered vulnerabilities could result in catastrophic fund loss • Oracle Manipulation: Data feed attacks could compromise settlement integrity • Infrastructure Failure: L2 network issues could disrupt platform operations • Key Personnel Risk: Despite decentralization, certain technical expertise remains concentrated

COMPETITIVE DISRUPTION RISK

Medium probability, medium impact threat: • Centralized Crypto Exchanges: Binance, Coinbase entry could capture significant market share • Traditional Sportsbook Innovation: Established operators adding crypto features • Regulatory Compliance: Licensed alternatives offering “good enough” decentralization • Technical Obsolescence: Superior DeFi protocols with better user experience

MARKET ADOPTION RISK

Medium probability, medium impact threat: • Crypto Market Cycles: Bear markets could reduce user activity and liquidity • User Experience Expectations: Mainstream users may demand features Overtime cannot provide • Network Effect Failure: Inability to achieve critical mass for sustainable liquidity • Token Economics Failure: $OVER flywheel mechanics may not function as designed

Risk Mitigation Strategies

REGULATORY APPROACH

• Legal Structure: Curaçao entity provides some regulatory cover • Decentralized Operations: DAO governance distributes legal risk • Technical Decentralization: Immutable contracts limit enforcement targets • Community Building: Strong user base could resist regulatory pressure

SECURITY MEASURES

• Ongoing Audits: Continuous security assessment as protocol evolves • Bug Bounty Programs: Incentivizing white-hat security research • Insurance Protocols: Potential integration with DeFi insurance solutions • Gradual Rollouts: Careful testing of new features before full deployment

STRATEGIC POSITIONING

• First-Mover Advantage: Early market position creates competitive moat • Community Lock-In: Strong user loyalty reduces switching risk • Technical Innovation: Continuous improvement maintains competitive edge • Partnership Development: Strategic relationships with L2s and other protocols

The risk landscape facing Overtime Markets is complex and evolving. While the protocol has demonstrated technical competence and market traction, its long-term success depends heavily on navigating regulatory uncertainty while maintaining the permissionless principles that define its unique value proposition.

Chapter 6: Strategic Assessment and Market Outlook

Analyzing Overtime Markets’ competitive position and future trajectory in the evolving DeFi landscape

As Overtime Markets matures from experimental DeFi protocol to established consumer application, its strategic position reveals both significant advantages and persistent challenges. The platform’s future success depends on its ability to leverage early-mover advantages while adapting to evolving competitive and regulatory pressures.

Core Strategic Advantages

TECHNICAL INNOVATION LEADERSHIP

Overtime has established multiple technological moats that provide competitive advantages:

Account Abstraction Pioneer:

• First-Mover Benefit: Early adoption of comprehensive AA framework1

• User Experience Superiority: Significant UX advantage over traditional DeFi interfaces

• Mainstream Accessibility: Social login capability expands addressable market beyond crypto-native users

• Development Lead Time: Competitors require significant resources to match UX innovation

Battle-Tested Infrastructure: • Proven Foundation: Built on audited Thales Protocol smart contracts20 • Production Validation: $200+ million in volume demonstrates system stability1 • Security Confidence: Extensive audit history provides user and LP assurance • Operational Reliability: Multi-chain deployment reduces single points of failure

Economic Model Innovation: • Aligned Incentives: $OVER tokenomics create sustainable value accrual mechanism3 • Democratic Liquidity: LP participation democratizes traditional “house” operations • Transparent Operations: Blockchain-based settlement eliminates counterparty risk • Self-Reinforcing Growth: Token flywheel mechanics support organic expansion

Competitive Positioning Analysis

VERSUS CENTRALIZED COMPETITORS

Overtime’s strategic positioning exploits fundamental weaknesses in traditional crypto betting platforms:

Value Proposition Differentiation:

• No KYC Requirements: Eliminates identity verification friction

• Censorship Resistance: Immutable contracts prevent arbitrary account restrictions

• Self-Custody: Users maintain complete control over funds

• Transparent Operations: Open-source contracts and blockchain settlement

Market Segmentation: • Sharp Bettor Focus: Explicitly targets users banned/limited by traditional platforms14 • Privacy-Conscious Users: Serves market segment prioritizing financial privacy • DeFi Natives: Captures users already familiar with Web3 protocols • Global Access: Serves users in restrictive regulatory jurisdictions

VERSUS EMERGING DEFI COMPETITORS

Within the nascent onchain sportsbook category, Overtime maintains competitive advantages:

Technical Leadership: • Account Abstraction: Significant UX advantage over wallet-dependent competitors • Multi-Chain Strategy: Broader market reach across L2 ecosystems • Liquidity Depth: Established LP base provides better betting limits • Feature Completeness: Advanced betting products (parlays, live betting, SGPs)

Network Effects: • User Base: 50,000+ active users provide liquidity and social proof1 • Volume History: $200+ million processed demonstrates market validation • Community Development: Strong user engagement creates switching costs • Partnership Ecosystem: Relationships with L2 foundations provide ongoing support

Market Opportunity Assessment

ADDRESSABLE MARKET ANALYSIS

Total Addressable Market (TAM): • Global Sports Betting: $455+ billion annually (Marcellus Investment)25 • Online Segment: ~$76 billion and growing rapidly • Crypto Betting: Emerging segment with significant growth potential

Serviceable Addressable Market (SAM):

• Crypto-Native Bettors: Users comfortable with blockchain interactions

• Privacy-Focused Segment: Bettors avoiding KYC requirements

• Restricted Jurisdictions: Users in markets with limited legal options

• Sharp Bettors: Professional players banned from traditional platforms

Serviceable Obtainable Market (SOM): • Early Adopters: Technology enthusiasts willing to try innovative platforms • DeFi Users: Existing Web3 participants familiar with protocol interactions • Word-of-Mouth Growth: Organic expansion through user recommendations • Account Abstraction Expansion: Mainstream users accessible through simplified UX

Growth Vector Analysis

MAINSTREAM MARKET PENETRATION

The Account Abstraction implementation positions Overtime for significant market expansion:

User Acquisition Potential:

• Simplified Onboarding: Social login eliminates technical barriers

• Gasless Transactions: Removes cryptocurrency acquisition requirements

• Web2-Familiar Experience: Interface comparable to traditional applications

• Value Proposition Communication: Better odds and instant withdrawals appeal broadly

Geographic Expansion Opportunities:

• Emerging Markets: Strong potential in regions with developing regulatory frameworks

• Restricted Jurisdictions: Service users where traditional betting is limited

• Crypto-Friendly Regions: Leverage regulatory acceptance in progressive jurisdictions

• Global Accessibility: Permissionless access serves worldwide user base

DEFI ECOSYSTEM INTEGRATION

Overtime’s onchain nature enables unique expansion opportunities:

Composability Benefits: • Money Lego Integration: Protocol interactions with other DeFi applications • Yield Strategy Integration: LP positions could become components of broader yield farming • Automated Betting Systems: Smart contracts could enable algorithmic betting strategies • Cross-Protocol Partnerships: Collaboration with other consumer DeFi applications

Institutional Interest: • DeFi Funds: Professional capital allocation to proven consumer protocols • Treasury Diversification: DAOs using Overtime for entertainment and potential yield • Research Interest: Academic and industry analysis of successful consumer DeFi

Threat Assessment and Risk Mitigation

REGULATORY EVOLUTION

Primary Threat Analysis: • Enforcement Risk: Government crackdowns could force operational changes • Compliance Pressure: Mandatory KYC/AML requirements could compromise value proposition • Banking Integration: Traditional finance restrictions could limit user onboarding • Jurisdictional Blocking: Geographic restrictions could reduce addressable market

Mitigation Strategies:

• Decentralized Architecture: DAO governance distributes legal risk

• Technical Decentralization: Immutable contracts limit enforcement targets

• Community Resilience: Strong user base provides political resistance

• Legal Advocacy: Industry-wide efforts to establish favorable regulatory frameworks

COMPETITIVE THREATS

Market Entry Risks:

• Big Tech Integration: Google, Apple adding crypto betting to existing platforms

• Exchange Expansion: Binance, Coinbase leveraging user bases for sports betting

• Traditional Innovation: Established sportsbooks adding DeFi-like features

• Regulatory Arbitrage: Licensed competitors offering “compliant decentralization”

Competitive Response: • Innovation Acceleration: Continuous feature development maintains technical leadership • User Experience Focus: Further UX improvements increase switching costs • Community Building: Stronger user engagement creates network effects • Partnership Development: Strategic relationships provide competitive moats

Future Outlook: Scenarios and Projections

BULLISH SCENARIO (40% Probability)

Regulatory Acceptance: Clear legal frameworks emerge supporting decentralized protocols

Mainstream Adoption: Account Abstraction drives significant user growth beyond crypto natives

DeFi Integration: Overtime becomes foundational infrastructure for broader DeFi ecosystem

Market Expansion: Platform captures meaningful share of global online betting market

Projected Outcomes:

• User Growth: 500,000+ active users within 3 years

• Volume Expansion: $2+ billion annual betting volume

• Token Appreciation: $OVER benefits from successful flywheel mechanics

• Industry Leadership: Overtime becomes template for consumer DeFi success

BASE CASE SCENARIO (45% Probability)

Regulatory Uncertainty: Mixed regulatory environment with varying jurisdictional approaches

Steady Growth: Platform continues expanding within crypto-native and adjacent markets

Competition: Successful defense of market position despite increasing competition

Technical Evolution: Continued innovation maintains competitive advantages

Projected Outcomes: • User Growth: 150,000+ active users within 3 years • Volume Expansion: $500+ million annual betting volume • Market Position: Leading position in decentralized sports betting maintained • Sustainable Operations: Platform achieves long-term financial sustainability

BEARISH SCENARIO (15% Probability)

Regulatory Crackdown: Coordinated government action significantly restricts operations Mainstream Rejection: Account Abstraction fails to attract non-crypto users Technical Issues: Security vulnerabilities or infrastructure failures damage user confidence Competitive Displacement: Superior alternatives capture significant market share

Projected Outcomes: • User Stagnation: Platform limited to niche crypto-native market • Volume Constraints: Regulatory pressure limits growth potential • Token Decline: $OVER value suffers from reduced platform utility • Strategic Pivot: Platform forced to fundamentally alter value proposition

Strategic Recommendations

FOR PROTOCOL DEVELOPMENT

Immediate Priorities (6-12 months):

• Security Audits: Comprehensive V2 system audit including Account Abstraction integration

• User Experience Optimization: Further reduction of friction in betting workflows

• Mobile Development: Native applications to compete with traditional sportsbook apps

• Legal Framework: Proactive engagement with regulatory developments

Medium-Term Development (1-3 years):

• Feature Expansion: Additional betting products and market coverage

• Cross-Chain Integration: Expansion to additional L2 and L1 networks

• Institutional Products: Services designed for professional and algorithmic trading

• Partnership Development: Strategic relationships with sports organizations and media companies

FOR TOKEN HOLDERS AND INVESTORS

Risk Management: • Regulatory Monitoring: Close attention to legal developments across major jurisdictions • Diversification Strategy: Overtime exposure balanced with broader DeFi portfolio • Community Participation: Active engagement in governance to influence protocol direction • Exit Strategy Planning: Clear criteria for reducing exposure if regulatory risks materialize

Growth Positioning: • Long-Term Perspective: Platform success likely requires multi-year development timeline • Technology Focus: Innovation leadership crucial for maintaining competitive advantages • Market Development: Early-stage market with significant upside potential • Network Effects: Strong community development could create durable competitive moats

Concluding Analysis: The Future of Decentralized Sports Betting

Overtime Markets represents a watershed moment in the evolution of decentralized finance—the first consumer application to successfully bridge the gap between complex DeFi primitives and mainstream user expectations. Its achievement of genuine product-market fit, evidenced by $200+ million in volume and 50,000+ active users, validates the potential for blockchain technology to disrupt traditional consumer services.

The platform’s strategic position combines significant advantages with persistent challenges. Its technical innovation leadership, particularly in Account Abstraction and user experience design, provides competitive moats that will be difficult for competitors to replicate quickly. The economic flywheel created by the $OVER token aligns stakeholder interests in a way that could drive sustained growth and value creation.

However, regulatory uncertainty remains the dominant factor influencing Overtime’s future trajectory. The platform’s core value proposition—permissionless, unlicensed global access—exists in direct tension with evolving government oversight of cryptocurrency and gambling activities. The outcome of this tension will likely determine whether Overtime becomes a foundational piece of the decentralized internet or remains a niche application for crypto-native users.

For the broader DeFi ecosystem, Overtime’s success provides a blueprint for consumer application development. It demonstrates that technical sophistication must be paired with user experience innovation to achieve mainstream adoption. More importantly, it shows that decentralized protocols can compete effectively with centralized incumbents when they provide genuinely superior value propositions.

The ultimate question for Overtime Markets is not whether it can continue to innovate technically—it has already proven that capability. The question is whether the regulatory and competitive environment will allow it to fully realize the potential of its technological and economic innovations. The answer to that question will have implications far beyond sports betting, potentially determining the viability of consumer-focused DeFi applications across all verticals.

As regulators, competitors, and users continue to react to Overtime’s pioneering model, the platform stands at an inflection point. Its next phase of development will likely determine not only its own future but also the broader trajectory of decentralized consumer applications in the global economy.

DISCLAIMER: This analysis presents findings from public sources and technical documentation. All financial projections are speculative and should not be considered investment advice. Cryptocurrency and DeFi protocols carry significant risks including total loss of capital. Regulatory changes could fundamentally impact protocol operations and token values. Readers should conduct independent research and consult qualified professionals before making investment decisions.