The Perfect Storm: When Old Sins Meet New Rules

The transformation of Curaçao from a regulatory haven into a legitimate gaming authority creates an existential threat for operators with checkered pasts. No company illustrates this vulnerability better than 1xBet, the Russian-founded betting giant whose corporate maze of bankruptcies, unpaid winnings, and shell company tactics represents everything the new National Ordinance on Games of Chance (LOK) was designed to eliminate.

Our previous investigation into Curaçao’s regulatory transformation revealed how the island dismantled its privatized licensing system in favor of direct state control. Now, with the Curaçao Gaming Authority (CGA) wielding genuine enforcement powers for the first time, operators like 1xBet face a reckoning that was previously impossible under the old regime.

The question isn’t whether 1xBet will face scrutiny under the new rules—it’s whether the company can survive it.

The 1xBet Bankruptcy Saga: A Case Study in Corporate Evasion

The legal battle surrounding 1xBet’s Curaçao operations reads like a masterclass in corporate obfuscation. At the center sits 1xCorp N.V., the Curaçao-registered entity that operated 1xBet under a sub-license—a company that became the target of a prolonged bankruptcy case that exposed the fundamental weaknesses of the old regulatory system.

The Foundation’s Crusade

The case began when the Foundation for the Representation of Victims of Online Gaming (SBGOK) filed suit on behalf of numerous players who claimed 1xBet had refused to pay out their winnings.¹ But this wasn’t just about individual grievances—the lawsuit also involved claims of millions in unpaid taxes owed to the Curaçao government, revealing a pattern of financial irresponsibility that extended beyond player disputes.

The legal proceedings dragged on for years, with 1xBet’s corporate structure adding layers of complexity that seemed designed to frustrate accountability. While 1xCorp N.V. was registered in Curaçao, the broader 1xBet brand claimed to be headquartered in Cyprus, operating on a franchise model, and conveniently denied that 1xCorp was its owner.²

The Shell Game Exposed

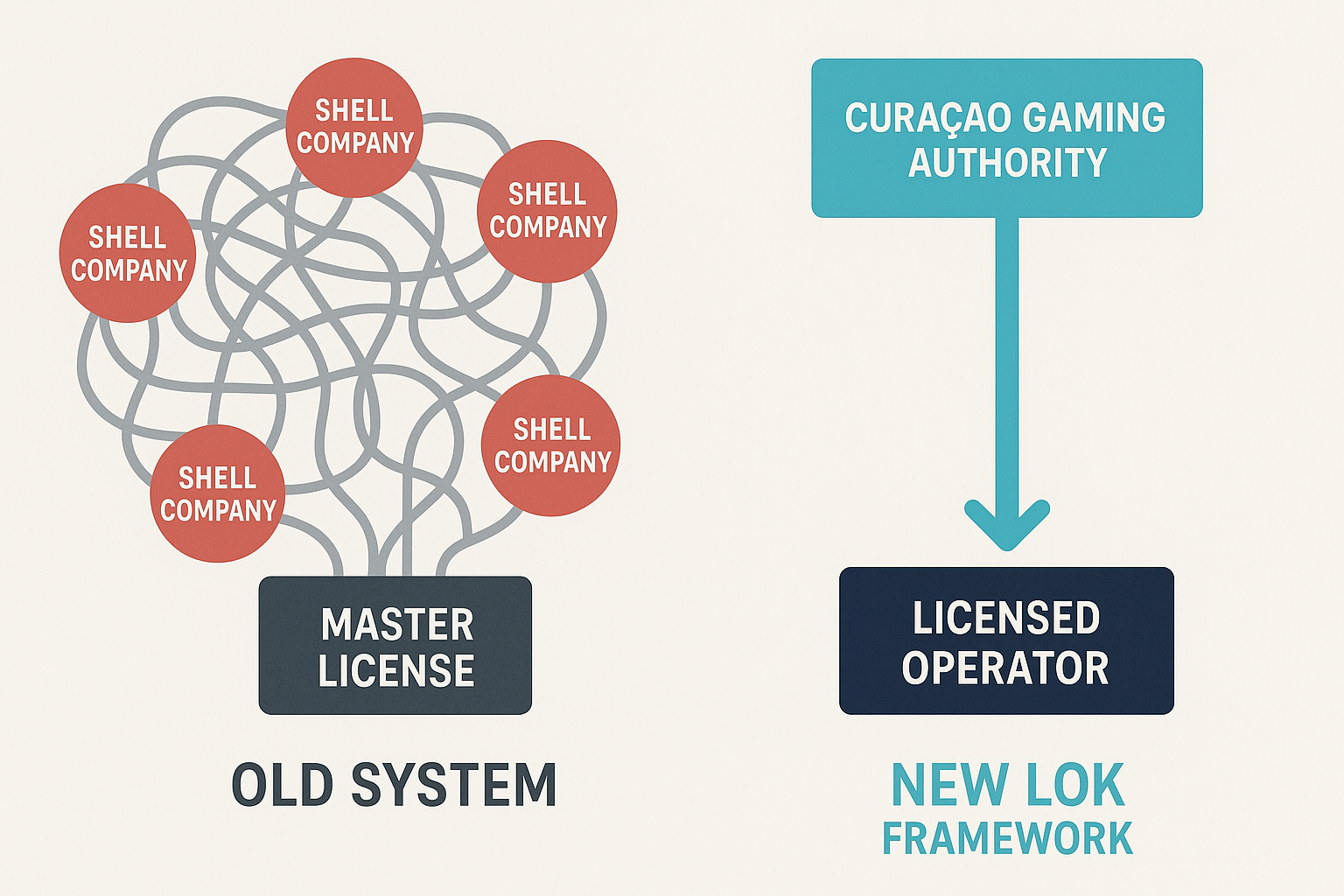

During the proceedings, observers noted that the 1xBet sites changed ownership multiple times, highlighting the use of complex corporate structures to obscure responsibility. This corporate shell game—moving assets and liabilities between related entities to avoid accountability—was precisely the kind of behavior that the old master license system enabled and the new LOK framework is designed to prevent.

After a series of appeals and overturned decisions, the Dutch Supreme Court ultimately upheld the bankruptcy ruling against the Curaçao-based entity.¹ But by then, 1xBet had already demonstrated its mastery of the regulatory arbitrage game that made Curaçao notorious in the first place.

The LOK Framework: Closing the Loopholes

The new regulatory environment under the LOK creates multiple chokepoints that directly target the tactics 1xBet has historically employed to operate in regulatory gray areas.

“Fit-and-Proper” Checks: No More Hidden Owners

Under the new system, all applicants for a Curaçao license must undergo rigorous due diligence and background checks conducted directly by the CGA. This includes intensive scrutiny of the company’s ultimate beneficial owners (UBOs) and key personnel—a process that strips away the corporate veils that companies like 1xBet have used to obscure their true ownership structures.

A history of bankruptcy, unpaid player winnings, and protracted legal battles represents exactly the kind of red flags that would trigger rejection during these integrity assessments. The CGA now has both the authority and the mandate to look behind corporate facades and assess the actual people controlling these operations.

Financial Segregation: Protecting Player Funds

Perhaps most critically for companies with 1xBet’s track record, the LOK now requires operators to prove they have sufficient liquidity to guarantee payouts and mandates that player funds be kept in segregated accounts, separate from operational finances.³ This requirement directly addresses the core issue in the 1xBet bankruptcy case—the inability or unwillingness to pay player winnings.

Under the old system, player funds could be commingled with operational expenses, creating the conditions for the non-payment issues that triggered the 1xBet case. The new segregation requirements make it much harder for operators to use player deposits to fund operations or pay other debts.

Direct Accountability: No More Master License Shield

The abolition of the master/sub-license system eliminates one of 1xBet’s most effective evasion tactics. Under the old regime, 1xBet could operate under the umbrella of a private master licensor, creating layers of separation between the company and the actual regulatory authority. The complexity of these relationships often made it unclear who was responsible for what.

Now, every company must apply for and hold a license directly from the CGA, making them directly accountable to the government regulator for their actions. There’s no private intermediary to hide behind, no complex sub-licensing arrangement to muddy the waters of responsibility.

Enhanced Enforcement: The CGA’s New Teeth

The CGA has been granted explicit authority to deny, suspend, or revoke licenses for non-compliance, and early signs suggest the regulator intends to use these powers aggressively. The authority has already begun taking a more forceful stance against illegal and non-compliant operations, issuing stern warnings that any company registered in Curaçao offering games of chance must hold a CGA-issued license.

Crucially, the CGA has confirmed that player complaints and dispute resolution reports will be integrated into its risk-based supervision process.⁴ For an operator with 1xBet’s history of player disputes and bankruptcy proceedings, this creates an immediate compliance vulnerability that didn’t exist under the old system.

The Rebranding Trap

1xBet might attempt to navigate the new system under a different corporate name or through a restructured entity, but the LOK’s focus on ultimate beneficial ownership makes such tactics far more difficult. The “fit-and-proper” person requirements mean that the same individuals who controlled the previous problematic operations would still be subject to scrutiny, regardless of what corporate wrapper they use.

Moreover, the CGA’s enhanced due diligence processes are specifically designed to identify attempts to circumvent regulatory requirements through corporate restructuring. The regulator now has both the legal authority and the investigative tools to trace connections between related entities and identify beneficial ownership patterns.

The Compliance Cost Calculation

Even if 1xBet could somehow pass the initial licensing hurdles, the ongoing compliance costs under the new framework would be substantial. The requirements for local substance (including maintaining physical offices and resident staff in Curaçao), regular independent audits, and certified software systems represent a significant operational burden that many operators may find economically unviable.

For a company that has historically competed on the basis of regulatory arbitrage—leveraging loose oversight to offer services that more strictly regulated operators cannot—the compliance-heavy environment of the new Curaçao may eliminate its competitive advantages entirely.

The Broader Implications

1xBet’s situation illustrates the broader transformation occurring in offshore gambling regulation. The days when operators could shop for the most permissive regulatory environment and then exploit loopholes to avoid accountability are rapidly ending. Curaçao’s transformation from regulatory Wild West to legitimate authority represents a broader trend toward compliance-focused regulation even in traditionally permissive jurisdictions.

For operators with clean records and sustainable business models, this transformation represents an opportunity to compete on a more level playing field. For operators like 1xBet, whose business models have historically depended on regulatory arbitrage and legal ambiguity, it represents an existential threat.

Conclusion: The Reckoning Arrives

The convergence of 1xBet’s troubled history with Curaçao’s regulatory revolution creates a perfect storm of compliance challenges. The company’s bankruptcy case, pattern of unpaid winnings, complex corporate structures, and history of legal battles represent precisely the kind of operational profile that the new LOK framework was designed to exclude from the jurisdiction.

While 1xBet may attempt various corporate maneuvers to maintain its Curaçao presence, the fundamental shift from a system based on regulatory leniency to one focused on compliance and accountability makes its long-term survival in the jurisdiction highly questionable. The same factors that allowed the company to thrive under the old system—complex ownership structures, financial opacity, and regulatory arbitrage—now represent fatal vulnerabilities under the new regime.

The transformation of Curaçao from haven to regulator is complete. For operators like 1xBet, the reckoning has only just begun.